Surge in unsecured loans may lead to crisis in banking system: RBI Governor

Share of unsecured loan rose to 25.2% in FY23 from 22.9% in FY21

Reserve Bank of India Governor Shaktikanta Das on Friday flagged concern over the recent surge in unsecured credit growth and asked banks and non-banking financial companies to strengthen their internal surveillance mechanisms as the change in credit composition may pose stress to financial stability.

In the last two financial years unsecured retail credit surged by 23% as against an overall credit growth of 12-14%. This has led to a significant change in credit composition. The share of unsecured retail loans in overall credit rose from 22.9% in the financial year 2020-21 to 25.2% in the financial year 2022-23. Consequently the share of secured loans declined from 74.8% in 2020-21 to 77.1% in 2022-23, as per the RBI data.

This change in loan composition has made the RBI worried. Governor Das made this evident in the monetary policy statement. “Certain components of personal loans are, however, recording very high growth. These are being closely monitored by the Reserve Bank for any signs of incipient stress,” he said.

“Banks and NBFCs would be well advised to strengthen their internal surveillance mechanisms, address the build-up of risks, if any, and institute suitable safeguards in their own interest,” Das said.

Governor further noted that the “need of the hour is robust risk management and stronger underwriting standards.”

“The global financial landscape is rapidly changing and potential stress may emerge from unanticipated corners. The Reserve Bank is closely monitoring the evolving situation and will act proactively to maintain financial stability,” he added.

Addressing the post monetary policy press conference, RBI Governor asked lenders to be mindful of future risk. “You have to be careful, you have to just keep your eyes and ears open. And nose also open. You have to smell where the crisis is likely to come up,” he said.

However, the governor ruled out any immediate threat to the banking system due to the rise in unsecured loans. At the moment, both the banks and non-banking financial companies are are stable, he added.

In his statement on monetary policy, Das noted the improvement in asset quality of banks. Provisional data as of June 2023 indicate that gross non-performing assets (GNPA) and net non-performing assets (NNPA) ratios of scheduled commercial banks declined to a decadal low of 3.6% and 0.9%, respectively. Capital adequacy ratio of commercial banks increased to 16.9% in June 2023 from 16.2% in June 2022.

The financial indicators of non-banking financial companies are also in line with that of the banking system as per the latest available data for June 2023, Das said.

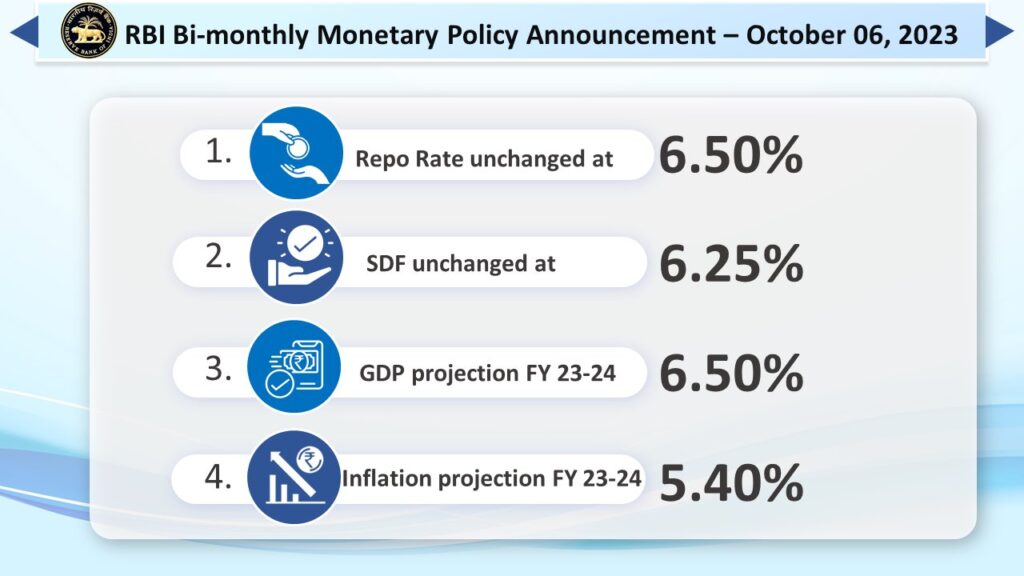

Meanwhile, the RBI’s Monetary Policy Committee on October 6 unanimously decided to keep policy repo rate unchanged at 6.5% for the fourth time in a row and signalled tight liquidity measures for a longer period reiterating the focus on bringing down retail inflation to 4%.

The status quo on policy repo rate means the interest rates on retail as well as corporate borrowings would remain stable. Repo rate is the interest rate at which the RBI lends money to commercial banks. This policy rate governs the interest rates on home, car and other loans.

Other policy rates also remain unchanged. The standing deposit facility rate, which the RBI introduced last year as an additional tool for absorbing liquidity, remains unchanged at 6.25% and the marginal standing facility (MSF) rate and the Bank Rate at 6.75%.

The MPC also decided by a majority of 5 out of 6 members to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth.

The repo rate was hiked cumulatively by 250 basis points between May 2022 and February 2023. There was corresponding increase in other policy rates also. This led to a sharp increase in equated monthly instalments (EMIs) on home, car and other loans.

The RBI’s rate setting panel not only maintained a status quo on key policy rates but also signalled a tighter liquidity situation for a longer period.

“We have identified high inflation as a major risk to macroeconomic stability and sustainable growth. Accordingly, our monetary policy remains resolutely focused on aligning inflation to the 4% target on a durable basis,” said RBI Governor Shaktikanta Das.

While the central bank’s rate setting panel left GDP growth as well as inflation forecasts unchanged, the tone remained hawkish in view of the uncertainties on crude oil price and agricultural output. Das emphasised that the central bank’s target is to keep retail inflation at 4% on a durable basis.

The central bank has left retail inflation target for the current financial year unchanged at 5.4% with Q2 at 6.4%, Q3 at 5.6%, and Q4 at 5.2%. For the first quarter of 2024-25 inflation is projected at 5.2%.

Consumer Price Index-based retail inflation, which the RBI monitors for its policy action, jumped to 7.44% in July, the highest in 15 months. It stood at 6.83% in August, sharply higher than the RBI’s upper tolerance limit of 6%.

The RBI has also kept the GDP growth forecast unchanged. The real GDP growth for 2023-24 is projected at 6.5%, with Q2 at 6.5%, Q3 at 6%, and Q4 at 5.7%. For the first quarter of 2024-25 GDP growth is projected at 6.6%. India’s gross domestic product (GDP) growth stood at 7.8% in April-June quarter of the current financial year, as per the latest data released by the government.