Reliance Industries becomes first Indian company to post pre-tax profit of over Rs 1 lakh crore

RIL posted record annual profit numbers despite a year-on-year decline in fourth quarter profit

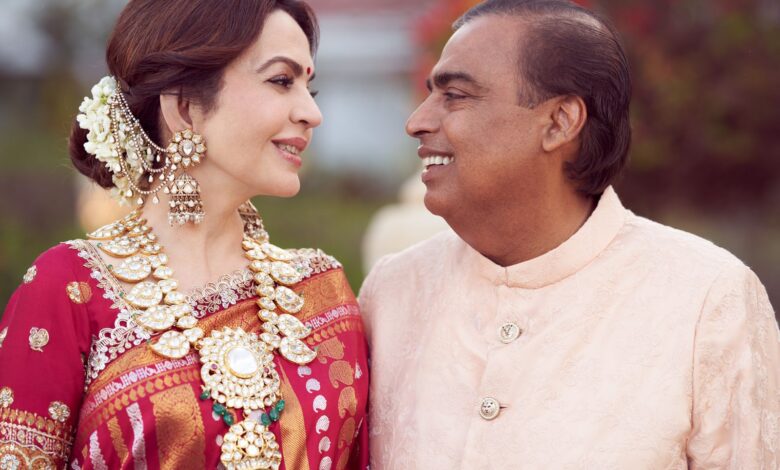

Billionaire Mukesh Ambani-led conglomerate Reliance Industries Limited (RIL) on Monday said its consolidated profit before tax jumped by 11.4% year-on-year to Rs 1.04 lakh crore ($12.6 billion) for the financial year ended March 2024, becoming the first Indian company to cross the lakh-crore-rupees profit threshold.

The company’s gross revenue during the financial year 2023-24 increased by 2.6% to Rs 10 lakh crore ($119.9 billion) supported by robust expansion in consumer and upstream businesses.

Commenting on the results, Mukesh Ambani, Chairman and Managing Director, Reliance Industries Limited said: “Reliance became the first Indian company to cross the Rs 100,000-crore threshold in pre-tax profits. Strong demand for fuels globally, and limited flexibility in refining system worldwide, supported margins and profitability of the O2C segment. Downstream chemical industry experienced increasingly challenging market conditions through the year. Despite headwinds, maintaining leading product positions and feedstock flexibility through our operating model that prioritises cost management, we delivered a resilient performance. The KG-D6 block has achieved 30 MMSCMD of production and now accounts for 30percent of India’s domestic gas production.”

RIL posted record annual profit numbers despite a year-on-year decline in fourth quarter profit. The company’s net consolidated profit for January-March 2024 quarter stood at Rs 18,951 crore against Rs 19,299 crore recorded in the corresponding period of the previous year, a decline of 1.8%. Analysts had predicted 5-10% contraction in Q4 profit.

Oil-to-telecom conglomerate reported a consolidated net profit (profit after tax) of Rs 79,020 crore for the financial year 2023-24, which is 7.3% higher when compared with the previous year.

The company’s tax expenses increased by 26.2% year-on-year to Rs 25,707 crore in 2023-24 on account of utilisation of tax credits in previous financial year, data released by RIL showed.

Capital expenditure for the year ended March 31, 2024, stood at Rs 131,769 crore with investments in pan-India 5G roll-out, expansion of retail infrastructure and new energy business.” This excludes amount incurred towards spectrum and is adjusted for capital advances and regrouping of assets,” RIL said.

“Performance of the digital services segment has been boosted by accelerated expansion of subscriber base, supported by both mobility and fixed wireless services,” Ambani said.

As per the company’s statement, Jio has rolled out its 5G network across India. Over 108 million 4G subscribers have migrated to Jio’s 5G network. It further claimed that Jio 5G network now carries around 28% of Jio’s wireless data traffic.

Net profit of Reliance Jio Infocomm, the telecom arm of RIL, increased by 13% to Rs 5,337 crore in Q4. The company’s revenue increased by 11% to Rs 25,959 crore during the quarter under review.

RIL’s board on Monday approved a dividend of Rs 10 per share for the financial year ended March 2024.

Share price of RIL closed 0.65% higher at Rs 2960.60 at the BSE on Monday. The stock has rallied by

14.32% in 2024 calendar year so far. The financial results were announced after closing of the market trading on Monday.

Reliance Consumer Products, FMCG arm of RIL, recorded a sales of over Rs 3,000 crore in 2023-24, the company’s first full year of operation. Campa Cola contributed around Rs 400 crore to this revenue.

“Acquisitions and partnerships continue to be a core part of our strategy for our consumer brands business,” said Dinesh Taluja, chief financial officer of Reliance Retail.

Reliance Retail’s net profit increased by 11.7% to Rs 2,698 crore in the quarter ended March 2024, led by strong growth in consumer electronics and fashion & lifestyle businesses.

The media business recorded a strong operating and financial performance across verticals during the quarter, with revenue showing a massive growth of 63 percent to Rs 2,419 crore, driven by sports, movies and news verticals. News business revenue grew by 25 percent during the same period, driven by the strong growth in advertising revenue for both TV and digital platforms.